Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

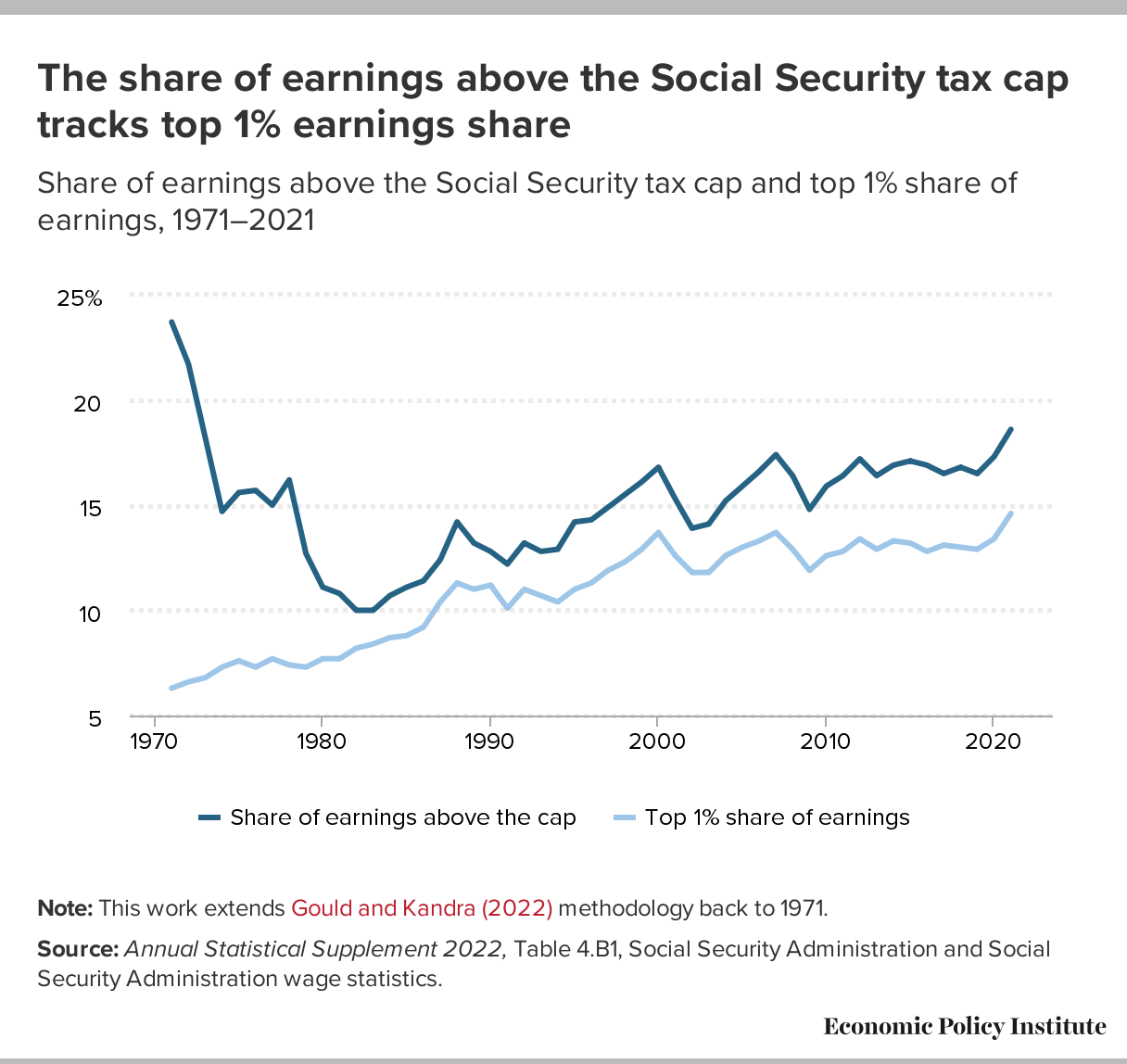

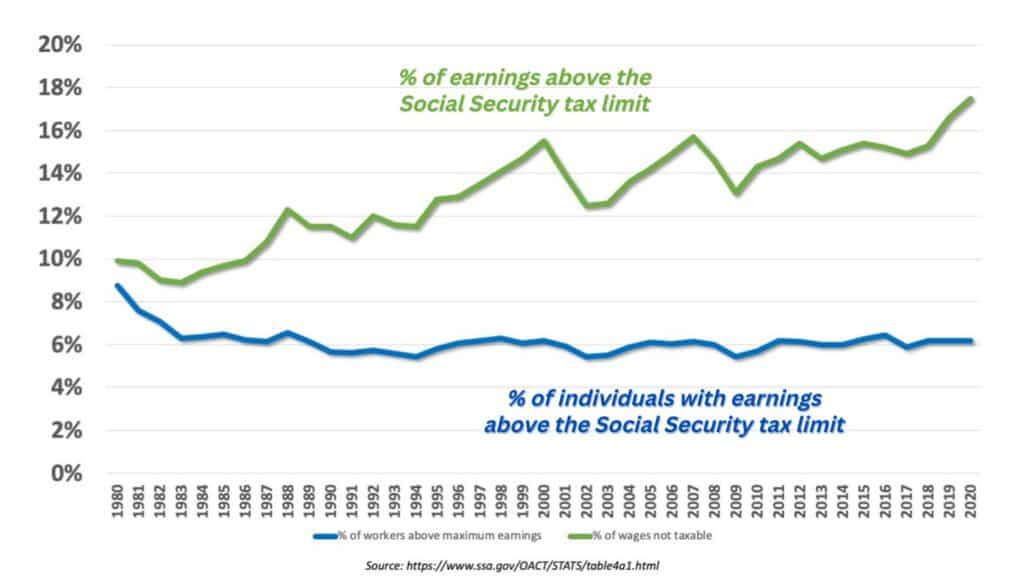

Who Would Pay More if the Social Security Payroll Tax Cap Were Raised or Scrapped? - Center for Economic and Policy Research

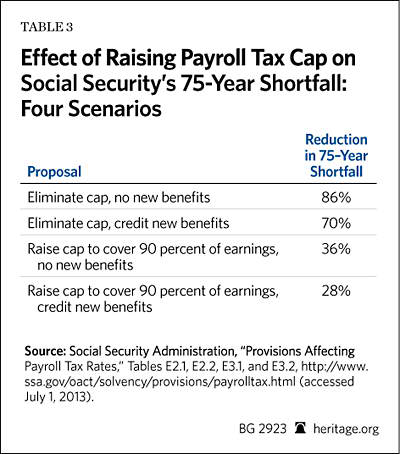

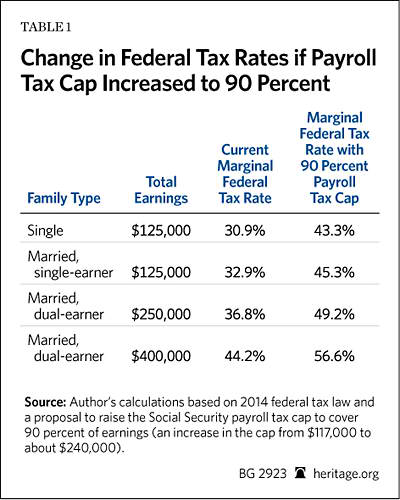

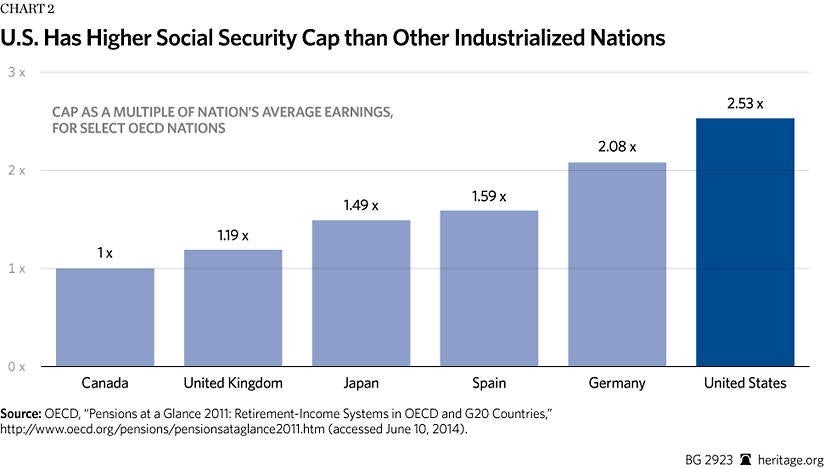

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

Scrapping the Social Security Payroll Tax Cap: Who Would Pay More? - Center for Economic and Policy Research

![Social Security Wage Base 2021 [Updated for 2024] - UZIO Inc Social Security Wage Base 2021 [Updated for 2024] - UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2024-1024x791.png)

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)